Financing Business

Business Outline

Financing services that provide greater convenience for customers

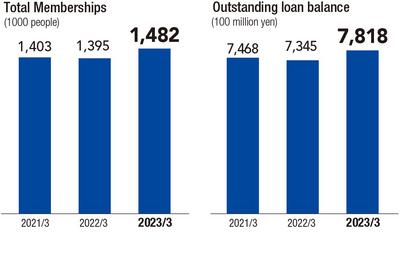

PROMISE is one of our financing business arms. Its main offering is Free Cashing (revolving loans), which meets the various borrowing needs of individual customers. Other offerings include Card Loans for the Self-employed, which meet the funding needs of self-employed individuals, and Consolidation Loans, which aim to ease the burden on those who are repaying multiple loans. In recent years, under the theme of digital transformation, we have been providing App Loans using our official app PROMISE as a platform in order to speedily meet customers’ financial needs. Utilizing the resources of the SMBC Group, in February 2022, we introduced V Points, a point service common to the Group, and in March 2023, we started issuing Promise Visa cards, which has credit functions from Sumitomo Mitsui Card Co., Ltd.

Channel Options

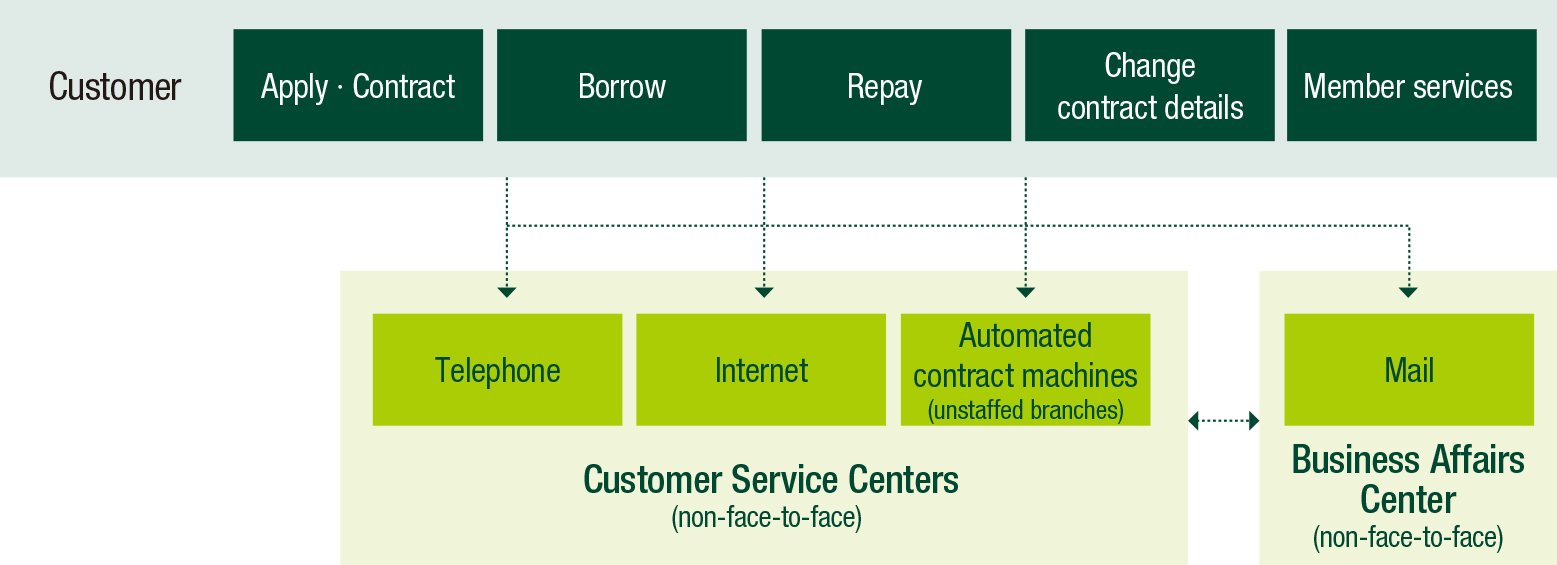

Various channels available to meet different customer needs

We have established a network of various channels in order to promptly meet customer needs for convenient services that can be used at any time, anywhere, with peace of mind. At our Customer Service Centers, located in eastern and western Japan, we receive and screen loan applications, and provide consultation and guidance on borrowing and repayment through contactless channels, including our automated loan contracting machines, the Internet, and telephone. In February 2023, we introduced a consulting service via smartphone, whereby customers can receive advice on an application for a new loan from an avatar whose voice and gestures are matched to one of our employees. This service allows us to present materials and share screens depending on individual customers’ inquiries. The Customer Service Centers have established a system that centrally holds information about individual customers’ use of our services and provides all kinds of support, thereby allowing customers to use our services with peace of mind. The Centers’ constant efforts to improve customer response quality have resulted in 11 consecutive years of certification under COPC,®* or international quality assurance standards for contact center operations, since 2013.

* The COPC® CX Standard for CSPs Release 7.0 is a global quality assurance standard that was developed specifically for contact center operations to improve customer satisfaction and ensure efficient operations. This certification is given to contact centers that have fulfilled and maintained the prescribed standards to an excellent level, particularly in relation to customer response performance.

New Service from PROMISE

V Point system launched—A shared point reward service for SMBC Group customers

The V Point system, a shared point reward service administered by Sumitomo Mitsui Card Company, Limited, was launched on February 21, 2022. The new system, which is shared across the SMBC Group, was created by updating the Sumitomo Mitsui Card World Present Point service and the SMBC Point system introduced on June 1, 2020. Customers can use their accumulated points in various ways. For example, they can add the points to the balance in the V Point app, which can be used to pay for purchases in Visa-affiliated stores, exchange their points for gifts, or transfer them to points systems operated by other companies. The Promise V Point service is provided through the official Promise app. Customers can earn points under this convenient system by using the official Promise app or making monthly payments. These points can then be exchanged for purchases or gifts. On July 25, 2022, we further enhanced the usability and benefits of the system and expanded the range of uses by introducing a new points consolidation service, which allows users to combine Promise V Points with Sumitomo Mitsui Card V Points and SMBC V Points.