Loan Guarantee Business

Business Outline

Expanding the loan guarantee business, and applying our credit investigation expertise

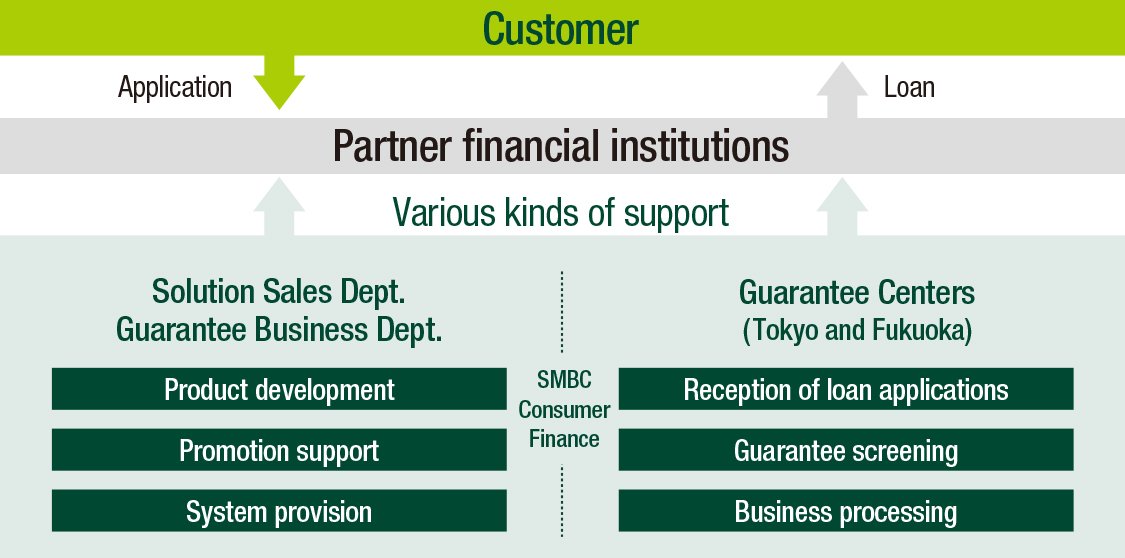

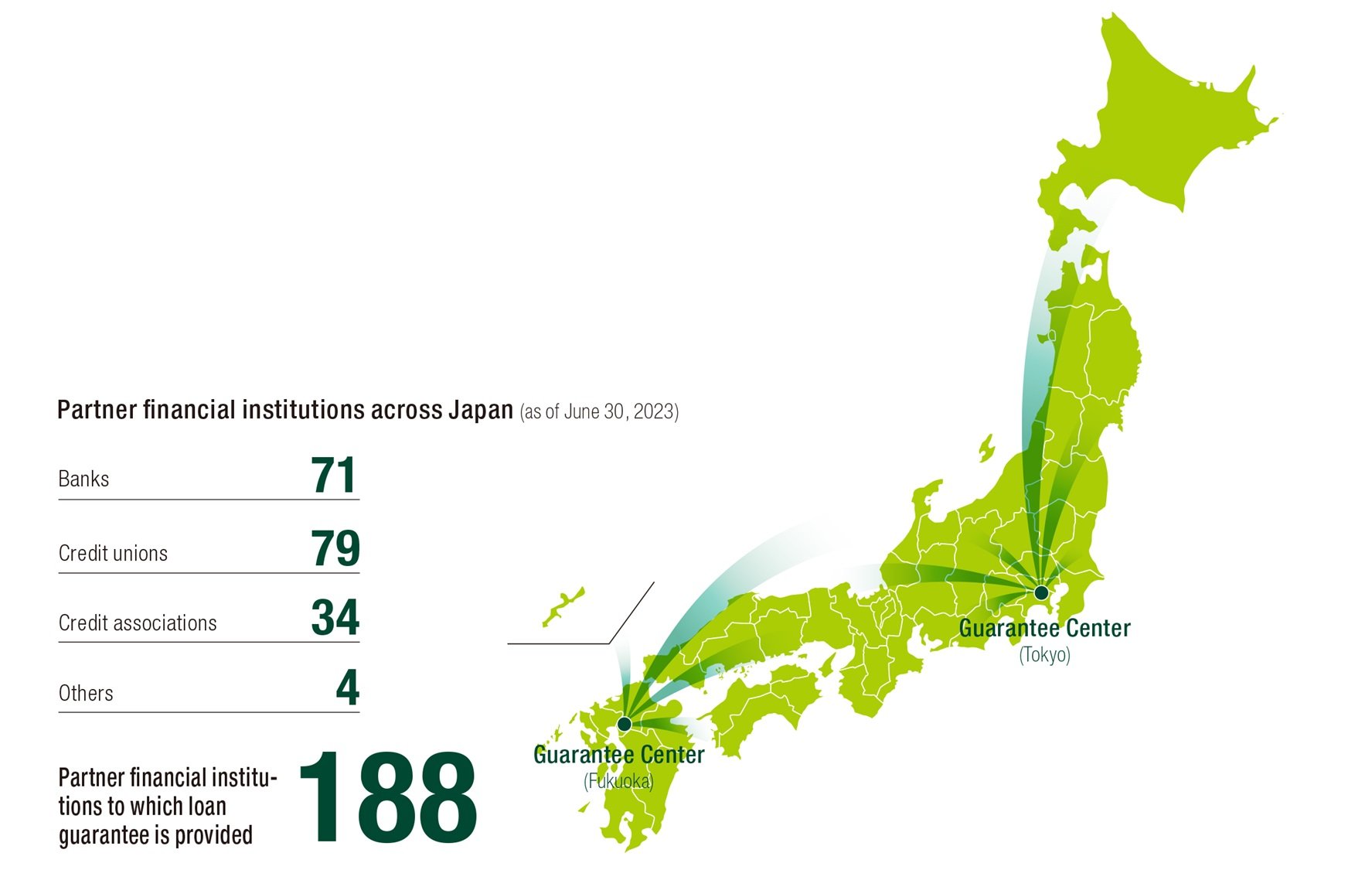

SMBC Consumer Finance engages in the loan guarantee business, building upon years of experience in credit investigation and loan management. In this business, we conduct a guarantee screening as the loan guarantee company after our partner financial institution receives the loan application when a customer submits it to a financial institution for an unsecured personal loan. Based on the result of our guarantee screening, the financial institution provides the customer with the loan. If it becomes difficult for the customer to repay the loan, we will repay the financial institution on the behalf of the customer. In the loan guarantee business, which commenced in April 2003, we now provide loan guarantees to financial institutions in many parts of the country after forming a loan guarantee partnership with SMBC, a Group company, in 2005.

Partner financial institutions(as of June 30, 2023)

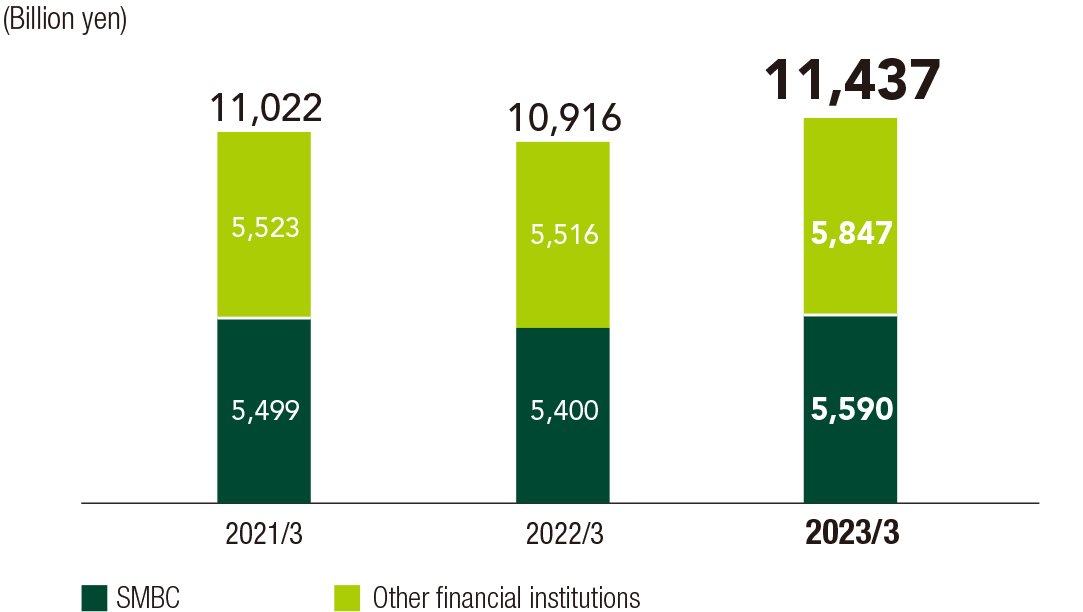

Guaranteed loans outstanding

At our Guarantee Centers in Tokyo and Fukuoka, we are entrusted with guarantee screening and reception business for unsecured personal loans provided by our partner financial institutions. In October 2018, they received COPC®*2 certification, an international standard for contact center business quality assurance, for the first time in Japan as a guarantee center that provides BPO operations*1. We also dispatch our employees to several financial institutions with which we have an alliance, including the SMBC Card Loan Plaza which opened in 2005, and harness our expertise to work together in running call centers by providing support for their establishment and operation. We will continue to meet a broad range of customer funding needs by developing products tailored to the characteristics and needs of our partner financial institutions, make proposals on sales promotions and other matters, and properly conduct credit investigation.

*1 Business Process Outsourcing. It refers to the continuous entrustment of a series of business processes from outside companies.

*2 The COPC®CX Standard for CSPs Release 6.2 is a global quality assurance standard specifically for the contact center business that is formulated to improve the level of customer satisfaction and ensure efficient operations. Certification is given to contact centers that have achieved and maintained the standard at a superior level, particularly in relation to customer service performance.

Support tailored to a wide variety of needs