Dedicated to Excellence

Medium-term management plan

We have formulated a medium-term management plan for the three-year period starting from fiscal 2023, "We will continue to support the future of our customers and society." Based on the previous medium-term management plan, we have evolved the strategies of "expanding the market share of core businesses," "remarkably strengthening the management foundation," and "developing business into new business areas." Based on the premise of our corporate strategy, we aim to achieve sustainable growth through initiatives based on four strategies.

policy

Always supporting the future of customers and society

~CFP Declaration “PROMISE Customer First”

picture of the future

A pioneer in consumer finance

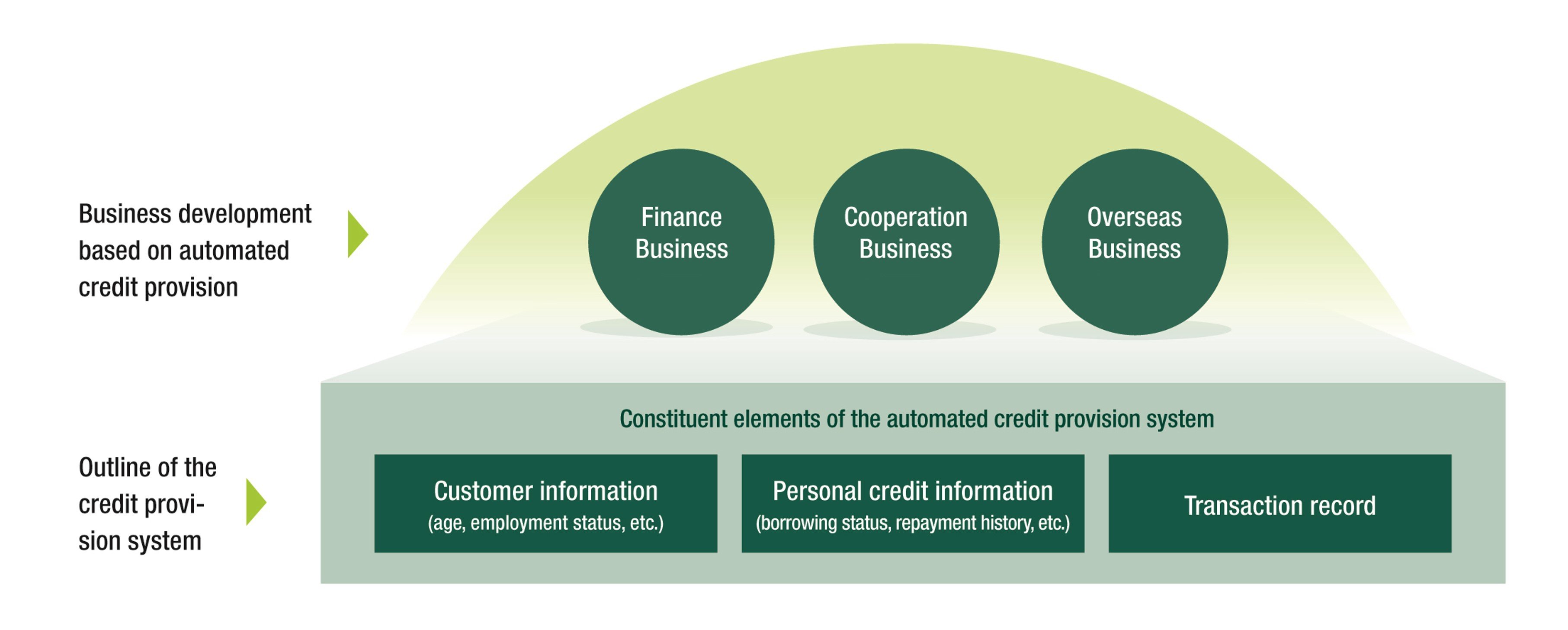

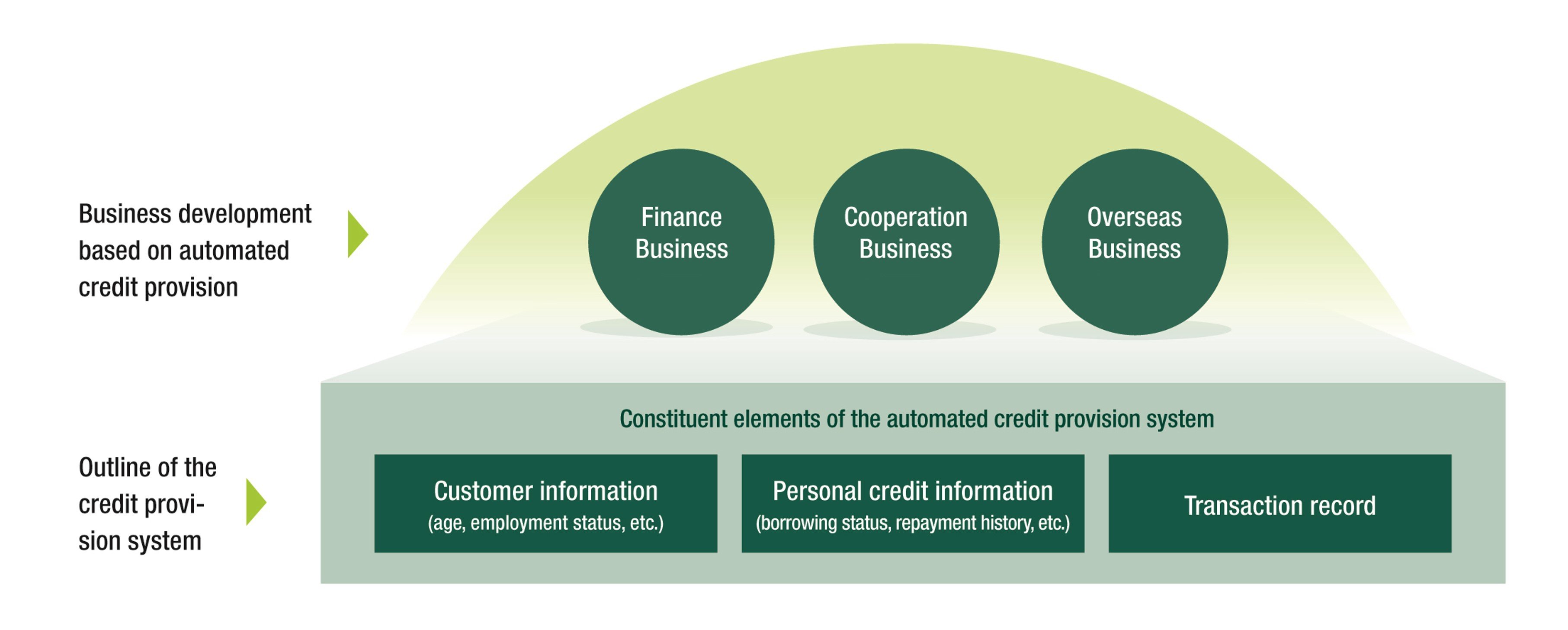

Our company was established in March 1962. In response to the changing times, we have developed highly convenient and safe personal loan products, and we have established a system for receiving various consultations and contracts. We provide consumer financial services that can quickly respond to the diverse financial needs of people. Leveraging the business skills and know-how we have cultivated over more than 50 years since our founding, we have developed our main business of finance business (financing of small funds and Loan management), cooperation business and overseas business.

Outline of the credit provision system